Turn your equity into reality

Whether you dream of renovations, educations, or exotic vacations, the equity you've built in your home can turn dreams into reality.

Use Some Now, Some Later

A Home Equity Master Line allows you to use portions of your equity as you need it. It's a revolving line of credit and you only pay interest on the amount you borrow. You can even lock portions of your line to fix the rate.

Borrow Up to $500,000[1]

For primary residences, loan amounts can be as high as $500,000, depending on appraised value.

Lower Interest

The best part about a Home Equity Master Line is that you'll generally pay a lower interest rate compared to other financing sources (like a personal loan or credit card).

Variable Rate With Fixed Rate Option

The best of both! The Master Line is a home equity line of credit with a variable rate, and it allows you to "lock" up to three separate loan balances at a fixed rate.

Easy Access

Write checks[2] or transfer funds from your Home Equity Master Line into your checking account. With online and mobile banking, it's also easy to manage the loan and make payments.

Consolidate High-Rate Debt

Save money and streamline your payments by consolidating higher rate loans into your Master Line.

Rates

View ratesEstimate your monthly payment

Let's see what your monthly payment could be.

Monthly Payment

Make it happen with this low-rate loan option

Did you know a Home Equity Master Line can be used for anything?

✔ Debt consolidation

✔ Home renovations

✔ Education expenses

✔ Passion projects

✔ A vacation

✔ Wedding expenses

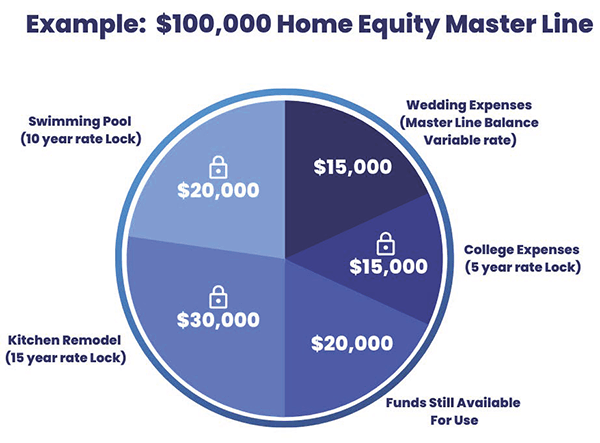

One Master Line, Many Uses

With a Master Line, you can lock portions of your line at a fixed rate as you go. For special projects, like a pool, wedding, or kitchen remodel, you can fix those loans under one line of credit, while still retaining the ability to use the remaining line for other needs. See the example below.

Already have a Home Equity Master Line?

To easily request a lock on your Home Equity Master Line, fill out this form with your lock information below and the Loan Department will be in touch with you!

Marim was very patient, I had several transactions but made me feel comfortable. Had a question for bank manager, she too was able to answer in a polite demeanor.

I was able to get my request done quickly and courteously.

Very helpful. Very knowledgeable. A very pleasant experience.

I was greeted with a smile and had great customer service

How it works

It’s easy to obtain a Home Equity Master Line with us

Step 1

Breeze through our Home Equity Master Line application online.

Step 2

We’ll touch base to help and answer any questions.

Step 3

Start using your Home Equity Master Line.

Your home can provide cash you need

Home equity is a valuable asset

-

APR = Annual Percentage Rate.

[1] Based on collateral valuation of the property and credit union guidelines

[2] Minimum loan advance is $500.00

Annual Percentage Rate (APR) is based on the following formula: the highest commercial prime-lending rate of interest as published in the Wall Street Journal, Western Edition, on the most recent publication date prior to the first day of the quarter, or index plus a margin. The minimum interest rate is 8.00% APR. The index, margin, floor rate of interest and APR will be disclosed to you when the loan is approved. There are no annual limits to rate changes. However, it will not increase above 18% APR.

Payment Example:

Pay $20.28 per month per $1,000 borrowed at 8.00% APR for 60 months.

Pay $9.56 per month per $1,000 borrowed at 8.00% APR for 180 months.

Pay $8.05 per month per $1,000 borrowed at 8.50% APR for 300 months.Note: Fees to open a Home Equity Master Line of Credit range from $241.00 to $1,118.00 based upon the collateral valuation used and amount of initial advance. Property insurance is required; flood insurance may be required. Minimum payment amount of $50 is required. A $25.00 annual fee will be assessed. Actual interest rate will be provided upon approval of a completed loan application. Other restrictions may apply.

Mocse Credit Union NMLS #757328

Rates

Home Equity

| Term | Financing | Min APR | Max APR |

|---|---|---|---|

|

|

Up to 80% |

|

|

|

|

Up to 80% |

|

|

|

|

Up to 80% |

|

|

|

|

Up to 80% |

|

|

|

|

Up to 80% |

|

|

|

|

Up to 70% |

|

|

|

|

Up to 70% |

|

|

|

|

Up to 70% |

|

|

|

|

Up to 70% |

|

|

|

|

Up to 70% |

|

|

Rates effective as of: June 30, 2025

APR - Annual Percentage Rate

Test Modal

Modal Content

Ea rerum vel molestiae omnis molestias. Et ut officiis aliquam earum et cum deleniti. Rerum temporibus ex cumque doloribus voluptatem alias.

| Column Title | Column Title | Column Title |

|---|---|---|

|

Cell Value |

Cell Value |

Cell Value |

|

Cell Value |

Cell Value |

Cell Value |

|

Cell Value |

Cell Value |

Cell Value |

|

Cell Value |

Cell Value |

Cell Value |

|

Cell Value |

Cell Value |

Cell Value |

Rates effective as of: June 30, 2025

{Optional: Insert table disclosure information}

Open Account

Leaving Our Website

You are leaving our website and linking to an alternative website not operated by us. We do not endorse or guarantee the products, information, or recommendations provided by third-party vendors or third-party linked sites.